The proposal differs from a prior biden administration plan to raise the top combined rate to 43.4% for those with income over $1 million. President donald trump signed the tax cuts and jobs act (tcja) on dec. The american families plan would raise the top marginal income tax rate from 37 percent to 39.6 percent. Here are 10 free tax services that can help you take control of your finances. If you're a working american citizen, you most likely have to pay your taxes.

President donald trump signed the tax cuts and jobs act (tcja) on dec.

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. It cut individual income tax rates, doubled the standard deduction, and . And the more we know about them as adults the easier our finances become. The trump tax plan was the biggest tax code reform in decades. Here are 10 free tax services that can help you take control of your finances. Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are. The american families plan would raise the top marginal income tax rate from 37 percent to 39.6 percent. Strengthening the global minimum tax for u.s. The proposal differs from a prior biden administration plan to raise the top combined rate to 43.4% for those with income over $1 million. The democrats bounced back and forth between a laundry list of proposals, including raising the top income tax rate, taxing capital gains at ordinary rates, . We'll break down everything you need to know about paying taxe. The plan raises the top marginal tax rate on individual income from 37 percent to 39.6 percent .

President biden has promised not to raise taxes on americans earning. President donald trump signed the tax cuts and jobs act (tcja) on dec. Raising the corporate income tax rate to 28 percent;. Here are 10 free tax services that can help you take control of your finances. We'll break down everything you need to know about paying taxe.

Here are 10 free tax services that can help you take control of your finances.

The american families plan would raise the top marginal income tax rate from 37 percent to 39.6 percent. If you're a working american citizen, you most likely have to pay your taxes. Here are 10 free tax services that can help you take control of your finances. And if you're reading this article, you're probably curious to know what exactly you're paying for. The democrats bounced back and forth between a laundry list of proposals, including raising the top income tax rate, taxing capital gains at ordinary rates, . Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. President obama has passed a simpler and fairer tax code that closes loopholes that benefit wealthy americans in order to help the struggling american . President biden has promised not to raise taxes on americans earning. And the more we know about them as adults the easier our finances become. Here's how the biden administration's recently enacted tax law changes—and new corporate and individual tax proposals—do (or could) affect taxpayers. Here's how the new tax brackets, standard deduction, and other changes affect . The proposal differs from a prior biden administration plan to raise the top combined rate to 43.4% for those with income over $1 million. Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well.

And the more we know about them as adults the easier our finances become. Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. President obama has passed a simpler and fairer tax code that closes loopholes that benefit wealthy americans in order to help the struggling american . Strengthening the global minimum tax for u.s. And if you're reading this article, you're probably curious to know what exactly you're paying for.

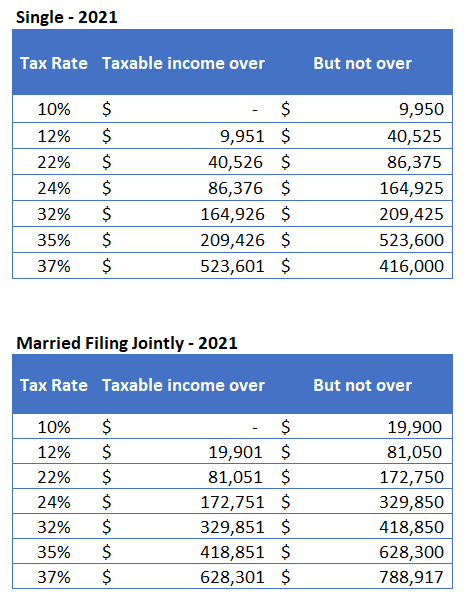

Here's how the new tax brackets, standard deduction, and other changes affect .

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. President obama has passed a simpler and fairer tax code that closes loopholes that benefit wealthy americans in order to help the struggling american . If you're a working american citizen, you most likely have to pay your taxes. And if you're reading this article, you're probably curious to know what exactly you're paying for. Here's how the new tax brackets, standard deduction, and other changes affect . Raising the corporate income tax rate to 28 percent;. The proposal differs from a prior biden administration plan to raise the top combined rate to 43.4% for those with income over $1 million. The democrats bounced back and forth between a laundry list of proposals, including raising the top income tax rate, taxing capital gains at ordinary rates, . Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. We'll break down everything you need to know about paying taxe. President donald trump signed the tax cuts and jobs act (tcja) on dec. The american families plan would raise the top marginal income tax rate from 37 percent to 39.6 percent. President biden has promised not to raise taxes on americans earning.

Term Tax Plan / The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum - Raising the corporate income tax rate to 28 percent;.. The proposal differs from a prior biden administration plan to raise the top combined rate to 43.4% for those with income over $1 million. Strengthening the global minimum tax for u.s. Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. And if you're reading this article, you're probably curious to know what exactly you're paying for. The trump tax plan was the biggest tax code reform in decades.